-

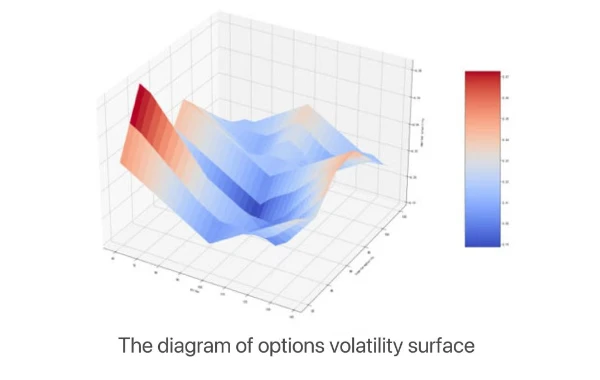

Volatility surface trading

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Strategy for single-variety trading

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Strategy for multiple-variety trading

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Single-month strategy

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Multi-month strategy

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Trans-variety trading of options With regard to volatility surface

if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Market timing strategy for volatility

On account of the change to volatility itself, for example, buy volatility when rising and sell it when declining, so as to earn profit from volatility fluctuation

-

Normal market (par means position held by seller, and the buyer being out of the money)

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Volatility change (Vega)

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Time value

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Change by large margin (Holding the position by the buyer turns into par)

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Volatility change (Vega)

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Market change

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Gamma

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Delta

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Volatility skewness

On account of the volatility difference between Skew and par, conduct trading on difference in option price so as to earn profits from the change in volatility skewness.

-

Change in volatility difference

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Vega

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Volatility surface With regard to volatility surface

if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Change in volatility difference

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Vega

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Multi-period volatility change

On account of the change in near-month and far-month volatility, sell (buy) near-month volatility, and buy (sell) far-month volatility. Earn profits from change in trans-month volatility

-

Vega

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Multi-period price change

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Price difference

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Volatility difference

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Vega

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface

-

Price change

Conduct trading by utilizing the change in the price relation of the same object but between different varieties.

-

Price difference

With regard to volatility surface, if selling volatility overestimates the contract, and buying volatility underestimates the contract, wait for the restoration of volatility surface